Overview#

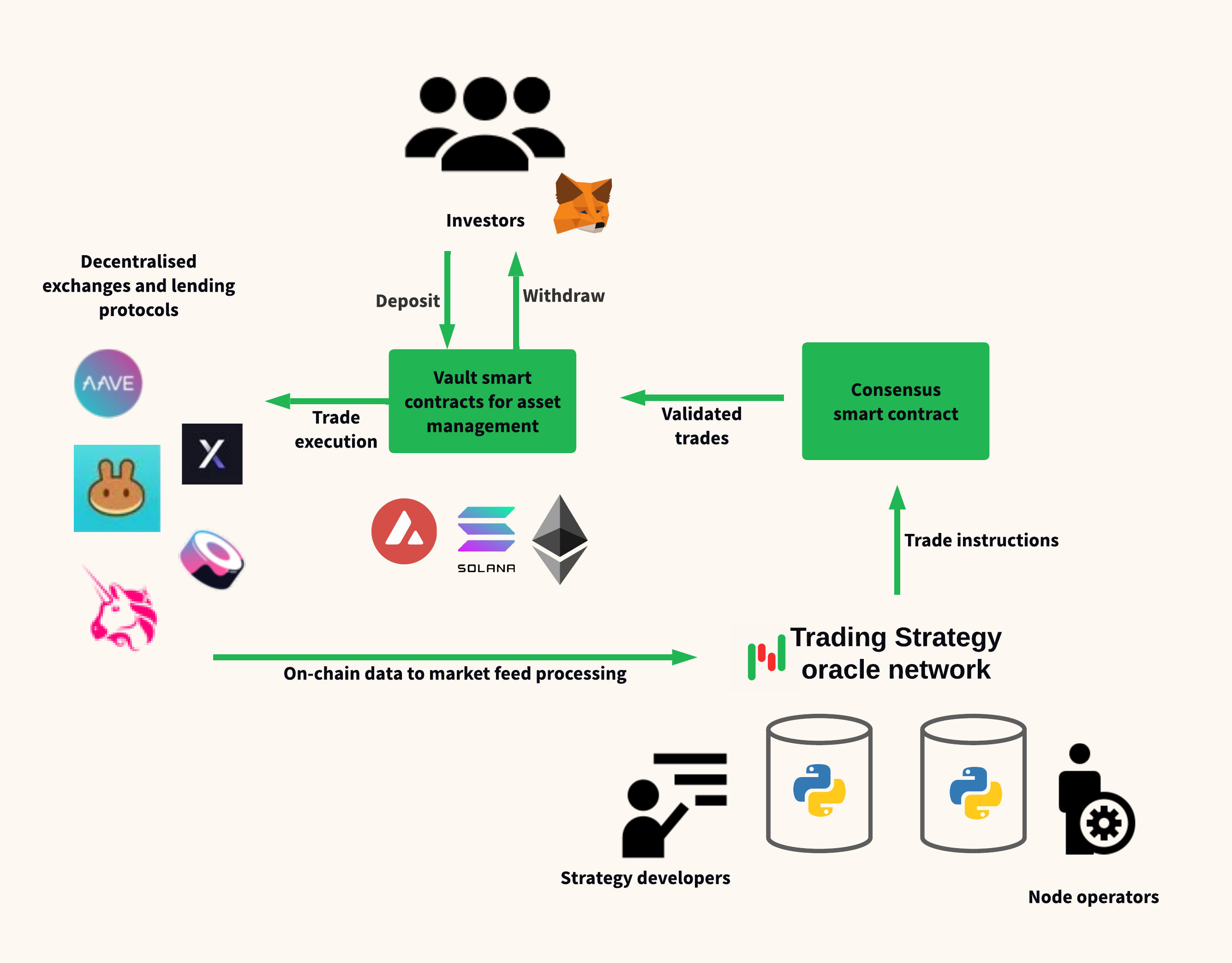

Algorithmic trading strategies can be deployed as autonomous agents running on smart contracts and Trading Strategy oracle network. Strategies then trade on decentralised exchanges.

After deployed, investors can invest in and withdraw from the strategies in real-time, using their non-custodial cryptocurrency wallet.

As strategies run on-chain, any third party can verify the honest execution of the strategies and fee distribution.

Protocol stakeholders#

Investors#

Investors can deposit and withdraw into the different strategies based on their risk profile

Strategies are listed based on their performance characters like assets traded, maximum drawdown and the strategy asset under management cap.

Investors can choose a strategy suitable for their available asseta and risk apetite.

Investors deposit and withdraw into a strategy in real-time, using a stablecoin like USDC.

All strategies are non-custodial based on vault smart contracts. Investors can transact with the vault without any middleman. Each strategy has its own isolated vault for isolating any risk.

Strategy developers#

Strategy developers are quantitative finance experts who have deep inside in defi and decentralised exchange markets.

Strategy developers program new algorithmic trading strategies.

Strategy developers are rewarded for the strategy creation e.g. with profit sharing fees from the strategy profits.

In Trading Strategy protocol, strategy developers do not need to possess low-level blockchain or Solidity programming skills. Instead, strategies are written in high-level Python scripts.

Node operators#

Node operators are the responsible for running oracles that make the Trading Strategy protocol possible.

Node operators are sufficiently decentralised entities, ensuring that the oracle network stays honest.

Node operators’ core skillset is maintaining high-availability servers that process market data feeds

Node operators are paid for the running the oracle nodes as a staking rewards that come from the profit sharing of the strategies

Components of the protocol#

Oracle#

An oracle is a server that forms a network node in Trading Strategy protocol network. The Trading Strategy protocol network is made from multiple oracles.

Oracles process data off-chain, as opposite to on-chain yield farming strategies. This gives oracles much more power to arrive to trade decisions. An on-chain smart contract can use around 4 kilobytes of data to make a decision, whereas Trading Strategy oracles can process gigabytes of data per trade.

Oracles read raw data from on-chain DeFi services like decentralised exchanges. Then, oracles proces this data to market data feeds, like price time-series.

Unlike in other oracle networks, Trading Strategy oracle possess intelligence and capacity to make complex calculations. Instead of just feeding the price data, oracles also run strategies. Oracles execute the trading strategies with market data feeds as input. The strategies then generate trade instructions for entering or exiting trade positions,

Oracles are deterministic. Anyone can start a new oracle and it will arrive to the same trade instructions based on the same blockchain data fed to it. Thus, it is easy for new oracles to join the protocol network and leave from it, without causing interruptions for the protocol.

Decentralised exchange#

A decentralised exchange is a venue where oracles trade.

All trading happens on-chain. Because oracles act as autonomous agents they cannot enter into a contract with a traditional finance entities. All interaction with decentralised exchanges happens through smart contracts.

Popular decentralised exchanges include Uniswap, PancakeSwap, Serum, TraderJoe, DyDx, Perp.fi and SushiSwap.

Vault smart contract#

A vault smart contract is responsible for managing segregated investor assets.

Each strategy has its own vault smart contract. Vault smart contracts are isolated from each other to isolate risk.

Each investor has a stake in a strategy vault contract, in the form of share tokens.

Share tokens are given to the investor when the investor deposits to the vault.

Share tokens can be redeemed against the profits of a vault, and then the underlying principal withdrawn.

Investors interaction happen only with the vault smart contract. There are no centralised services.

EIP-4626 is a popular vault smart contract standard for EVM-compatible blockchains.

Consensus smart contract#

A consensus smart contract validates the trade instructions coming from the oracle network.

Sufficiently decentralised oracle network ensures the high quality of the service and guaranteed transparency.

Oracles run the code off-chain. Oracles need to reach a consensus on trade positions. For this, the results of oracle calculations and resulting trade instructions need to be verified on-chain. Causes for the oracles disagreeing the results include market data feed issues, downtime, malfunctioning or manipulation attempts.

A simple majority rule is the simplest form of consensus.

The consensus smart contract may punish misbehaving oracles by dropping their rewards.

Strategy#

A strategy is a Python script that decides the trades.

A trading strategy protocol can run multiple strategies, created by strategy developers.

Strategies are executed on the network of oracle servers.

A strategy can use the full power of Python programming language, on powerful oracle servers. This may include machine learning and such novel AI concepts.

Trading Strategy protocol comes with its own Developing strategies for creating strategies.

Live trading strategies are fed with market data feeds, but strategies can be backtested against historical data.

Strategies calculate different term:technical indicators <technical indicator> based on data feeds, like :term`OHLCV` price candles. The main sources of indicators are price, volume and liquidity data, but alternative data sources like on-chain analytics and sentiment can be used as well.

Strategies then make trading decisions to enter and exit positions. A strategy can trade a single trading pair like ETH/USD or have complex trading universe of several thousands of assets for portfolio construction.

Both backtested and live profit and risk performance allows investors to make decisions on which strategies they invest in.

If you are into Python and trading algorithm development yourself, check out Deprecated Strategy Examples.