Trading Strategy documentation#

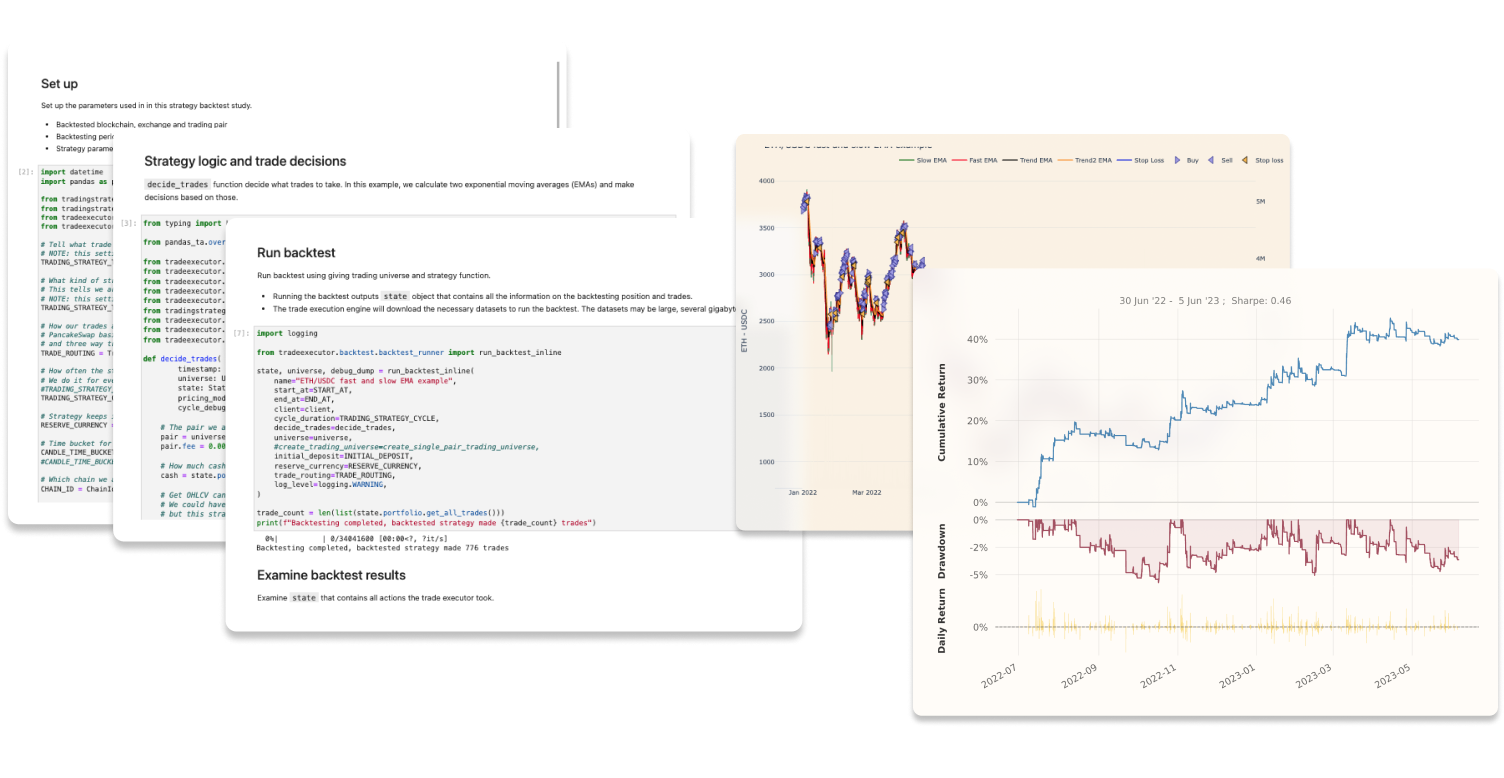

This is the technical documentation for Trading Strategy algorithmic trading framework and protocol.

The documentation is divided into three parts: overview, trading strategy development framework and trading strategy protocol.

Note

If you want to get started with writing or porting your own algorithms, you can directly jump to Getting started Github repository, which provides Github Codespaces cloud environment and Visual Studio Code Dev Container to develop and backtest strategies right away.

Table of contents#

See also#

This is the landing page for the technical documentation. Quick links to elsewhere: